Dive deep into the intricacies of the 15 March 2024 NSE Share Bazaar, dissecting the fluctuations of Nifty Fifty, Option Chain data, NiftyBank, and FII/DII activities to discern whether the relief rally is indeed transient or indicative of a broader market trend.

Nifty 50’s Volatile Journey on 15 March 2024

On the eventful day of 15 March 2024, the Nifty 50 index embarked on a journey marked by volatility and uncertainty. Opening with a notable loss of 82 points at 22,064.85, compared to the previous close of 22,146.65, it set the tone for a day of fluctuations.

Nifty Spot’s Intriguing Highs and Lows

As the trading day commenced, the Nifty Spot surged to a notable high of 22,120.90, signaling potential bullish sentiment among traders. However, this optimism was short-lived as the index experienced a sharp decline, reaching a low of 21,931.70 around 11:10 AM.

Recovery Amidst Uncertainty

Despite the initial downturn, the Nifty demonstrated resilience and staged a recovery, climbing to a high of 22,050 near 3 PM. This resurgence amidst prevailing uncertainty left traders questioning the sustainability of the relief rally.

Analyzing Nifty’s Closure

Ultimately, the NSE Share Bazaar concluded with the Nifty 50 closing at 22,023.35, marking a marginal loss of 0.56% compared to the previous close. This modest decline, coupled with the day’s fluctuating performance, left traders pondering over the underlying market sentiment and future trajectory.

Insights into NiftyBank’s Performance

Parallel to Nifty’s journey, NiftyBank exhibited its own set of dynamics. Opening with a significant loss of 218 points at 46,572.10, compared to the previous close of 46,789.95, it mirrored the volatility witnessed in the broader market.

Comparative Analysis: Nifty vs. NiftyBank

While both indices experienced losses, NiftyBank’s performance appeared relatively robust. Despite the initial setback, it showcased resilience and recovery, closing at 46,594.10 with a loss of 0.42%, signaling potential strength within the banking sector amidst market fluctuations.

Deciphering FII/DII Activities

The 15th of March 2024 witnessed notable activity from Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII), providing valuable insights into market sentiment and investment trends. FII bought 848.56 crores worth of equity in the cash segment, whereas DII sold 682.26 crores worth of equity, reflecting a nuanced interplay between institutional investors.

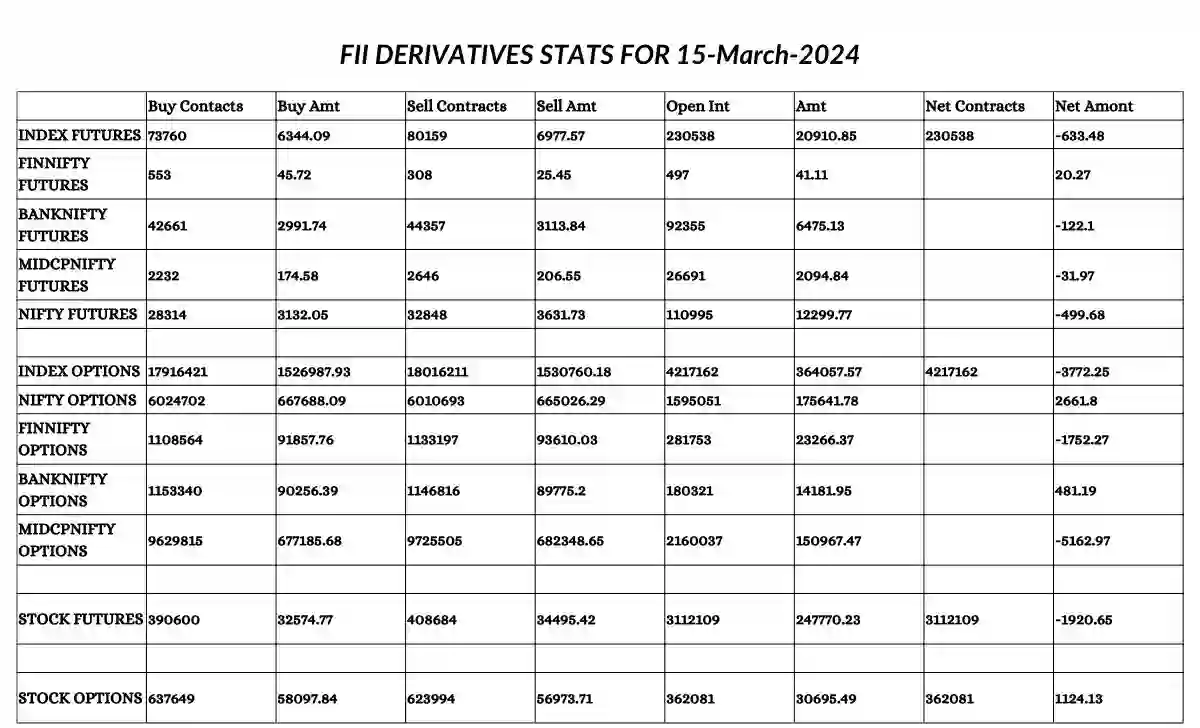

FII Derivative Statistics for 15 March 2024

You can refer to the image below containing the FII derivative statistics for 15 March 2024.

Long-to-Short Ratio Unveiled

A closer examination of FII’s long-to-short ratio in Index futures revealed intriguing insights into their positioning amidst market fluctuations. The ratio stood at 0.60, reflecting a shift in sentiment compared to the previous trading day, indicating potential adjustments in investment strategies.

Also Read:

- Nifty Support at 21900? 18 March 2024

- Relief Rally? 14 March 2024 NSE Share Bazaar

- A Deep Dive into 13 March 2024 NSE Share Bazaar

Spotlight on Top Gainers and Losers

Within the Nifty Index, certain stocks emerged as top gainers and losers, providing further insights into market dynamics. UPL, BHARTIARTL, and HDFCLIFE were among the top gainers, while M&M, BPCL, and COALINDIA grappled with losses, highlighting the diverse performance within the market.

Navigating Through BankNifty’s Terrain

Exploring the highs and lows of BankNifty, alongside insights into the top gainers and losers within the banking sector, offers a comprehensive perspective on financial market trends and sectoral dynamics.

Unraveling Option Chain Data: Nifty

Delving into the option chain data for Nifty’s 21 March 2024 Expiry unveils significant changes in Open Interest Calls and Puts. Understanding these shifts provides valuable cues for market participants in navigating through market volatility and making informed trading decisions.

Decoding Option Chain Data: BankNifty

Similarly, analyzing BankNifty’s option chain data for the 20 March 2024 Expiry offers insights into notable shifts in Open Interest Calls and Puts. Deciphering these trends equips traders with valuable information to adapt their trading strategies and capitalize on market opportunities.

Exploring Sectoral Indices Performance on 15 March 2024

1. Nifty Next 50:

- Open Price: The Nifty Next 50 index commenced trading on 15 March 2024 at 58,414.35.

- High Price: It reached a peak of 58,661.10 during the trading session.

- Low Price: The index saw a low of 57,184.20.

- Closing Price: Concluding the day’s trading, the Nifty Next 50 settled at 58,058.80.

- Previous Close: In comparison to the previous trading day, there was a decrease, marking a change of -0.79%.

2. Nifty Midcap 100:

- Open Price: Trading began at 46,904.45 for the Nifty Midcap 100 index.

- High Price: The index saw a high of 47,145.30.

- Low Price: At its lowest point during the day, it reached 46,062.05.

- Closing Price: Ending the trading session, the Nifty Midcap 100 closed at 46,685.60.

- Previous Close: Compared to the previous trading day, there was a decrease, resulting in a change of -0.46%.

3. Nifty Auto:

- Open Price: The Nifty Auto index opened trading at 20,475.60.

- High Price: It reached a peak of 20,523.35.

- Low Price: At its lowest point, the index dipped to 20,066.80.

- Closing Price: Concluding the day, the Nifty Auto settled at 20,192.30.

- Previous Close: There was a decrease compared to the previous trading day, with a change of -1.57%.

4. Nifty FMCG:

- Open Price: Trading commenced at 54,013.95 for the Nifty FMCG index.

- High Price: The index saw a high of 54,464.95.

- Low Price: It reached a low of 53,886.70 during the trading session.

- Closing Price: The Nifty FMCG concluded the day’s trading at 54,155.45.

- Previous Close: Compared to the previous trading day, there was a slight increase, resulting in a change of 0.02%.

5. Nifty IT:

- Open Price: The Nifty IT index started trading at 37,524.35.

- High Price: It reached a high of 37,592.05 during the trading session.

- Low Price: The index saw a low of 37,264.90.

- Closing Price: Ending the day’s trading, the Nifty IT settled at 37,500.70.

- Previous Close: There was a decrease compared to the previous trading day, with a change of -0.47%.

6. Nifty Metal:

- Open Price: The Nifty Metal index commenced trading at 7,802.05.

- High Price: It reached a high of 7,855.45 during the trading session.

- Low Price: At its lowest point, the index dipped to 7,684.85.

- Closing Price: Concluding the day, the Nifty Metal settled at 7,802.65.

- Previous Close: There was a slight increase compared to the previous trading day, resulting in a change of 0.03%.

7. Nifty Pharma:

- Open Price: Trading began at 18,876.80 for the Nifty Pharma index.

- High Price: The index saw a high of 18,916.20.

- Low Price: At its lowest point during the day, it reached 18,588.85.

- Closing Price: Ending the trading session, Nifty Pharma closed at 18,718.45.

- Previous Close: Compared to the previous trading day, there was a decrease, marking a change of -0.95%.

8. Nifty PSU Bank:

- Open Price: The Nifty PSU Bank index opened trading at 6,779.80.

- High Price: It reached a high of 6,855.20 during the trading session.

- Low Price: At its lowest point, the index dipped to 6,574.40.

- Closing Price: Concluding the day, the Nifty PSU Bank settled at 6,761.00.

- Previous Close: There was a decrease compared to the previous trading day, with a change of -0.35%.

9. Nifty Oil & Gas:

- Open Price: Trading commenced at 11,202.55 for the Nifty Oil & Gas index.

- High Price: The index saw a high of 11,269.50.

- Low Price: It reached a low of 10,770.15 during the trading session.

- Closing Price: Ending the day’s trading, the Nifty Oil & Gas closed at 11,058.80.

- Previous Close: There was a decrease compared to the previous trading day, resulting in a change of -1.98%.

Analyzing these sectoral indices provides investors with insights into the performance of specific sectors within the broader market, aiding in portfolio diversification and strategic decision-making.

Market Sentiment and Future Prospects

Assessing the prevailing market sentiment and anticipating future market trends based on technical analysis, institutional activities, and global economic indicators enables traders to formulate informed strategies and navigate effectively in dynamic market environments.

Conclusion: The Verdict on Market Stability

In conclusion, while the 15 March 2024 NSE Share Bazaar showcased resilience amidst volatility, the lingering uncertainty prompted traders to tread cautiously and reassess their positions. The question remains whether the relief rally is indeed short-lived or indicative of a broader market trend, underscoring the importance of adaptability and vigilance in navigating through ever-evolving market landscapes.