Analyzing the 28 March 2024 NSE Share Bazaar: Insights into Nifty 50, Option Chain, and FII/DII Data

Dive into the dynamic world of the Indian Stock Market with a comprehensive analysis of the 28 March 2024 expiry trading day, exploring trends in the Nifty 50, BankNifty, Option Chain movements, and institutional investor activities.

Introduction: Unveiling the NSE Share Bazaar Landscape

On the eventful trading day of 28 March 2024, the Nifty Fifty index showcased remarkable movements, reflecting both optimism and volatility within the Indian stock market.

Nifty 50 Performance: A Rollercoaster Ride

Commencing the trading day with a promising uptick, the Nifty Fifty index opened with a gain of 40 points, soaring to 22,163.60 from the previous close of 22,123.65. This initial surge set a positive tone for the day’s trading activities. Throughout the day, the Nifty index exhibited a consistent upward trajectory, reflecting bullish sentiments prevalent among market participants. This steady ascent was indicative of growing investor confidence and optimism regarding market prospects.

Influence of Derivatives Expiry: Unveiling Short Covering

As the day progressed, the influence of the monthly expiry of derivatives contracts became palpable. Short-covering activities emerged, adding a layer of complexity to the market dynamics. This phenomenon highlighted the intricacies of derivative trading and its impact on overall market sentiment. At its peak, the Nifty Spot reached an impressive high of 22,516.00 around 2:45 PM, showcasing the resilience of bullish momentum. However, this peak was short-lived, as a sudden bout of selling pressure ensued, causing the Nifty Fifty index to plummet by nearly 250 points from its day high within the last half-hour of trading.

Amidst the flurry of trading activities, expiry-related adjustments came to the forefront, contributing to heightened volatility in the market. These adjustments underscored the need for investors to navigate market fluctuations with agility and adaptability. Despite the volatility and sudden downturn witnessed towards the end of the trading session, the NSE Share Bazaar ultimately closed on a positive note, with the Nifty Fifty index settling at 22,326.90, marking a gain of 0.92%. This closing figure encapsulated the resilience of the market amidst fluctuating conditions.

BankNifty: Tracking Banking Sector Dynamics

BankNifty commenced the trading day on a positive note, opening with a gain of 42 points at 46,827.85, surpassing the previous day’s close of 46,785.95. This initial surge hinted at optimism within the banking sector and set the stage for further developments. Following its auspicious start, BankNifty wasted no time in gaining momentum, mirroring the upward trajectory observed in the Nifty index. The index swiftly climbed, reaching a day high of 47,440.45 around 2:45 PM, showcasing the resilience and bullish momentum prevalent within the banking sector.

However, akin to the Nifty Fifty index, BankNifty also encountered a pattern of selling pressure as the trading session progressed. This sudden downturn, reminiscent of broader market movements, contributed to fluctuations in BankNifty’s performance and underscored the interconnectedness of various market segments. Despite the early promise and subsequent challenges faced, BankNifty closed the trading day at 47,124.60, registering a loss of 0.72%. This closing figure encapsulated the day’s market sentiments and reflected the nuanced dynamics at play within the banking sector.

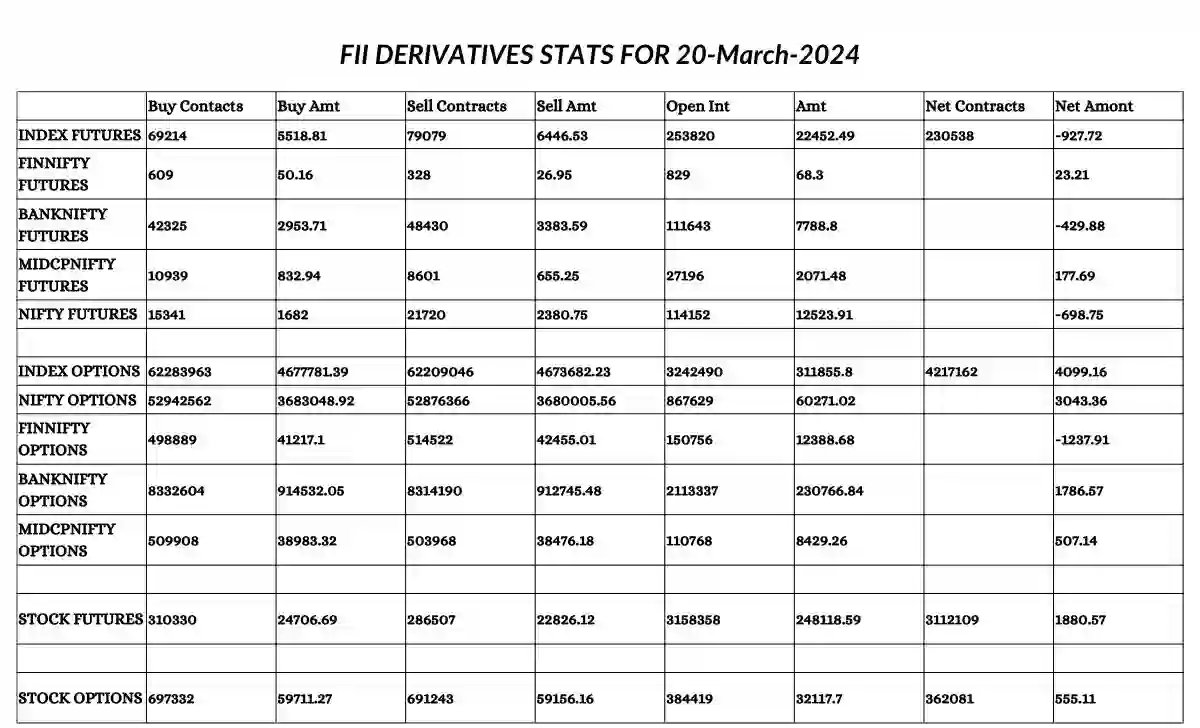

FII Derivative Statistics for 28 March 2024

You can download the image below containing the FII derivative statistics for 28 March 2024

Institutional Investor Activity in Cash Segment: FII and DII Insights

The 28th of March 2024 witnessed notable activity from institutional investors, shedding light on their buying patterns and market participation, providing valuable insights into market dynamics. On this eventful day, Foreign Institutional Investors (FIIs) purchased 188.31 crores worth of securities in the cash segment, signaling their active involvement in the market. Similarly, Domestic Institutional Investors (DIIs) also made significant purchases, acquiring equity worth 2,691.52 crores in the cash segment. Both FIIs and DIIs exhibited a strong buying sentiment, contributing to market liquidity and investor confidence.

On this eventful day, Foreign Institutional Investors (FIIs) purchased 188.31 crores worth of securities in the cash segment, signaling their active involvement in the market. Similarly, Domestic Institutional Investors (DIIs) also made significant purchases, acquiring equity worth 2,691.52 crores in the cash segment. Both FIIs and DIIs exhibited a strong buying sentiment, contributing to market liquidity and investor confidence.

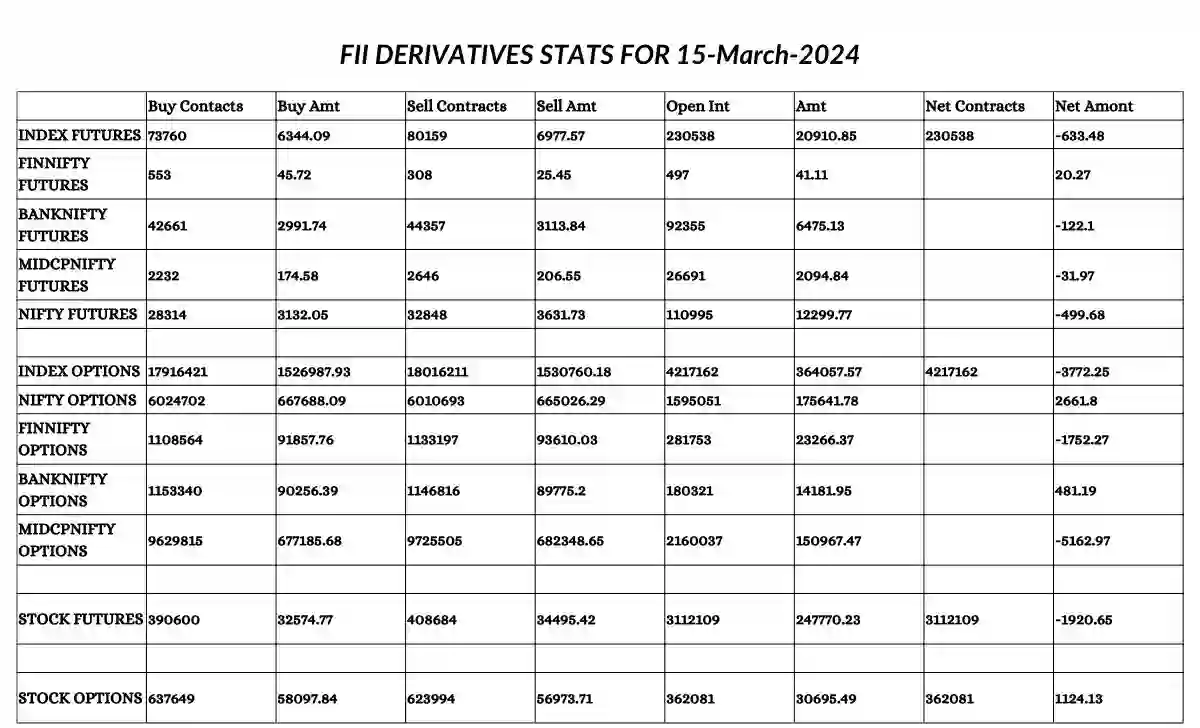

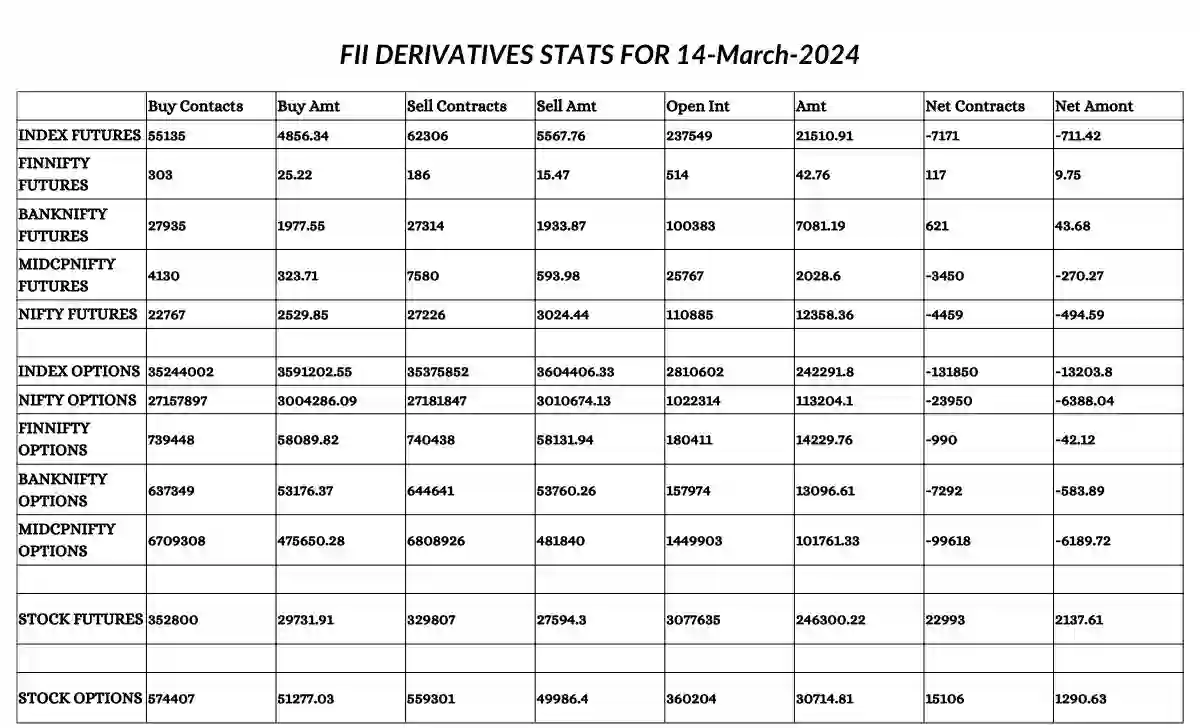

Long-to-Short Ratio in Index Futures: Unveiling FII Positioning

The long-to-short ratio in Index futures provides further insights into FII positioning within the market. On the 28th of March 2024, the long-to-short ratio in Index futures for FIIs stood at 0.81, indicating a notable increase from the ratio of 0.46 recorded on the 27th of March 2024.

Sectoral Analysis: Auto, FMCG, IT, Metal, Pharma, PSU Bank, and Oil & Gas

Nifty Next 50:

The Nifty Next 50 index opened at 60,079.70 and witnessed a notable high of 60,842.35, signaling positive momentum within this segment. With a closing price of 60,624.30, the index registered a commendable change of 1.19%, reflecting robust performance and investor interest in these mid-cap companies.

Nifty Midcap 100:

In the mid-cap segment, the Nifty Midcap 100 index displayed resilience, opening at 48,131.40 and reaching a high of 48,250.25. With a closing price of 48,075.75, the index recorded a change of 0.5%, underlining steady growth and stability within this segment.

Nifty Auto:

The Nifty Auto index showcased strength, opening at 21,222.50 and achieving a high of 21,607.80. Closing at 21,419.10, the index recorded a notable change of 1.29%, indicating positive investor sentiment and optimism towards the automotive sector.

Nifty FMCG:

The FMCG sector demonstrated resilience, with the Nifty FMCG index opening at 53,683.20 and peaking at 54,251.00. With a closing price of 53,949.20, the index registered a change of 0.76%, reflecting steady growth and consumer-driven demand within the FMCG space.

Nifty IT:

In the IT sector, the Nifty IT index displayed stability, opening at 34,862.60 and reaching a high of 35,203.25. With a closing price of 34,898.15, the index recorded a change of 0.44%, highlighting consistent performance and investor confidence in IT stocks.

Nifty Metal:

The metal sector exhibited strength, with the Nifty Metal index opening at 8,191.25 and achieving a high of 8,320.90. Closing at 8,257.20, the index recorded a change of 1.25%, indicating positive momentum and robust performance within the metal industry.

Nifty Pharma:

In the pharmaceutical sector, the Nifty Pharma index displayed resilience, opening at 18,824.20 and reaching a high of 19,082.05. With a closing price of 18,996.15, the index recorded a change of 1.21%, underscoring steady growth and investor confidence in pharmaceutical stocks.

Nifty PSU Bank:

The PSU banking sector showcased significant strength, with the Nifty PSU Bank index opening at 6,862.95 and peaking at 7,059.45. With a closing price of 7,007.25, the index recorded a remarkable change of 2.62%, reflecting robust performance and positive investor sentiment towards PSU banks.

Nifty Oil & Gas:

In the oil and gas sector, the Nifty Oil & Gas index displayed stability, opening at 11,408.75 and reaching a high of 11,541.40. With a closing price of 11,440.90, the index recorded a change of 0.66%, indicating steady growth and investor confidence in oil and gas stocks.

In summary, the performance of various Nifty indices on the 28th of March 2024 reflects a mix of resilience, stability, and strength across different sectors, underscoring the diverse opportunities and dynamics within the Indian stock market.

Also Read:

Option Chain Insights: Nifty and BankNifty Expiry

Top Three Changes in Open Interest Calls:

- 22400CE: The open interest for the 22400CE call option witnessed a significant increase, rising by 18,014 contracts. This surge suggests bullish sentiment among traders anticipating a potential price rise above the 22400 level.

- 22500CE: With a substantial increase of 38,173 contracts, the open interest for the 22500CE call option reflects heightened optimism, indicating expectations for a bullish movement above the 22500 level.

- 22300CE: The 22300CE call option also experienced a notable increase in open interest, rising by 18,175 contracts. This uptick suggests bullish sentiment, with traders anticipating a potential price surge above the 22300 level.

Top Three Changes in Open Interest Puts:

- 22500PE: The open interest for the 22500PE put option saw a significant rise, increasing by 18,490 contracts. This uptick in open interest indicates bearish sentiment, with traders hedging against potential downward movements below the 22500 level.

- 22400PE: With an increase of 21,264 contracts, the open interest for the 22400PE put option suggests heightened bearish sentiment, reflecting anticipation of a potential price decline below the 22400 level.

- 22300PE: The 22300PE put option witnessed a substantial surge in open interest, rising by 41,307 contracts. This significant increase indicates strong bearish sentiment, with traders positioning themselves for potential downward movements below the 22300 level.

BANKNIFTY Option Chain Data: 3 April 2024 Expiry

Top Three Changes in Open Interest Calls:

- 47000CE: The open interest for the 47000CE call option experienced a decrease of 10,807 contracts. This decline suggests a shift in sentiment, potentially indicating reduced bullish expectations for movements above the 47000 level.

- 47100CE: With an increase of 15,371 contracts, the open interest for the 47100CE call option reflects renewed bullish sentiment, signaling expectations for potential price rises above the 47100 level.

- 47200CE: The 47200CE call option witnessed a notable increase in open interest, rising by 25,750 contracts. This surge suggests heightened optimism among traders, anticipating potential upward movements above the 47200 level.

Top Three Changes in Open Interest Puts:

- 47200PE: The open interest for the 47200PE put option saw a significant rise, increasing by 45,379 contracts. This uptick in open interest indicates bearish sentiment, with traders hedging against potential downward movements below the 47200 level.

- 47100PE: With an increase of 30,064 contracts, the open interest for the 47100PE put option suggests heightened bearish sentiment, reflecting anticipation of potential price declines below the 47100 level.

- 47000PE: The 47000PE put option witnessed a substantial surge in open interest, rising by 64,802 contracts. This significant increase indicates strong bearish sentiment, with traders positioning themselves for potential downward movements below the 47000 level.

By analyzing the option chain data for both Nifty and BankNifty expiries, traders can gain valuable insights into market sentiment and potential price movements, enabling informed decision-making and strategic positioning in the derivatives market.

Conclusion: Deciphering Market Trends and Future Prospects

Summarizing the key takeaways from the 28 March 2024 NSE Share Bazaar, this section offers reflections on market trends and prospects for future developments.

By dissecting the intricate interplay of indices, option chain data, and institutional investor activities, investors and enthusiasts alike can gain valuable insights into the evolving landscape of the Indian Stock Market.