Relief Rally? 14 March 2024 NSE Share Bazaar Analysis & Insights

Delve into the intricacies of the 14 March 2024 NSE Share Bazaar performance, exploring the Nifty 50, NiftyBank, and Option Chain dynamics. Uncover expert insights to discern whether it’s a relief rally or a market’s bottom, backed by FII/DII data.

Market Overview on 14 March 2024

The 14 March 2024 NSE Share Bazaar commenced with anticipation as investors eagerly awaited the unveiling of market movements. The opening bell echoed with a subtle hint of caution as the Nifty Fifty initiated its journey with a minor setback, shedding 15 points compared to the previous day’s close. This initial dip hinted at underlying market tensions. However, amidst the early morning haze, the Nifty Spot experienced a brief descent to 21,917.50, only to swiftly rebound within a mere 20 minutes, showcasing the resilience of market bulls. The rollercoaster ride continued as bears attempted to exert dominance, yet the market once again found its footing, scaling to a commendable day high of 22,204.60. Finally, as the closing bell tolled, the NSE Share Bazaar painted a picture of optimism, clinching a gain of 0.68% and settling at 22,146.65, leaving investors with a mix of relief and anticipation for the days ahead.

Nifty 50 Performance

The Nifty 50, often regarded as the barometer of the Indian stock market, offered a fascinating spectacle on 14 March 2024. Despite the initial stumble, it exhibited remarkable resilience, culminating in a notable gain of 0.68% by the day’s end. This performance underscored the underlying strength of select stocks within the index, propelling the market toward positive territory. The fluctuations observed throughout the trading session reflected the dynamic interplay between market forces, providing investors with valuable insights into the prevailing sentiment.

NiftyBank Analysis

In stark contrast to the Nifty 50’s buoyancy, NiftyBank navigated through choppy waters on 14 March 2024. Opening with a notable loss of 156 points, it struggled to find its footing amidst prevailing market pressures. The divergence between NiftyBank and Nifty 50 highlighted the sector-specific challenges plaguing banking stocks. Despite a valiant effort to recover lost ground, NiftyBank concluded the day with a 0.41% loss, signaling caution within the banking sector and prompting investors to reevaluate their portfolios in light of sectoral dynamics.

FII/DII Data Insights

The activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) on 14 March 2024 provided invaluable insights into market sentiment. FIIs, wielding significant influence, opted to offload equities in the cash segment, amounting to a substantial sell-off of 1,356.29 crores. Conversely, DIIs seized the opportunity to bolster their portfolios, injecting 139.47 crores into the cash segment. This tug-of-war between FIIs and DIIs underscored the nuanced intricacies of market dynamics, leaving investors pondering over the implications of institutional actions on future market movements.

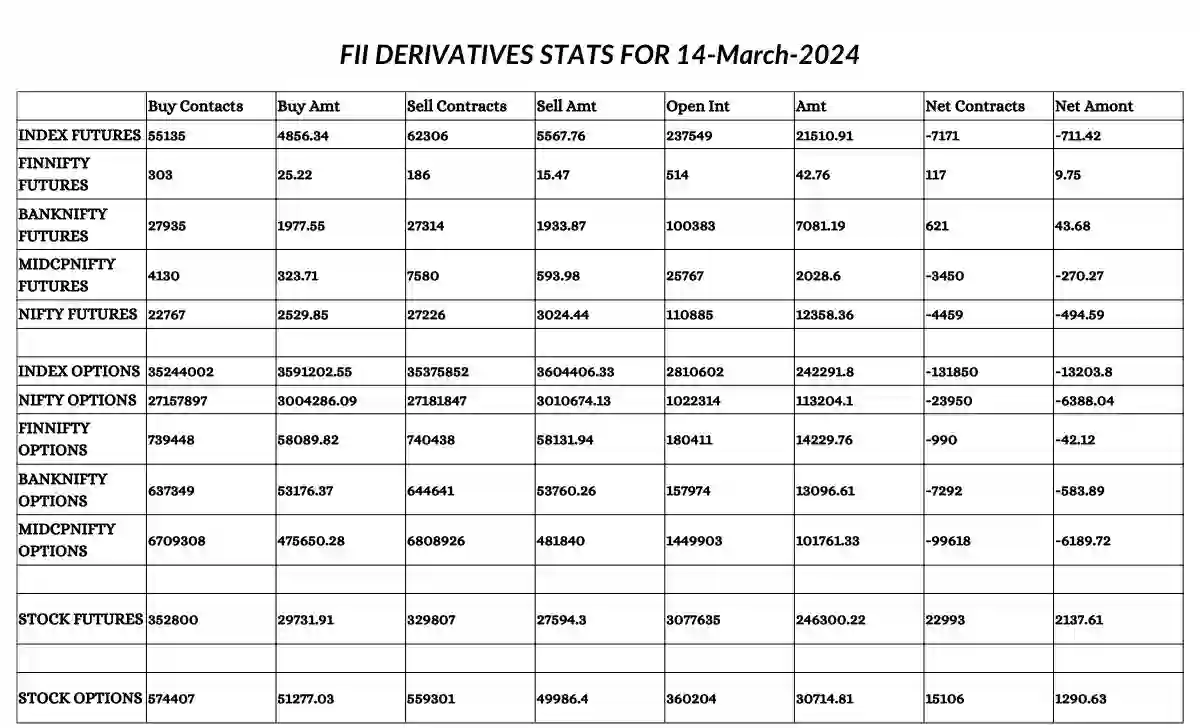

FII Derivative Statistics for 14 March 2024

You can save the image below for the FII derivative statistics for 14 March 2024.

Relief Rally or Bottoming Out?

Amidst the ebbs and flows of the market on 14 March 2024, a pivotal question loomed large: Was it merely a relief rally or had the market truly found its bottom? The dichotomy between short-term optimism and long-term structural shifts fueled speculation among investors. While the day’s gains provided a glimmer of hope, the underlying uncertainties lingered, prompting investors to tread cautiously and seek clarity amidst the fog of market volatility.

NIFTY Spot Analysis

The NIFTY Spot, serving as a focal point for market activity, underwent meticulous scrutiny on 14 March 2024. Post-options expiry, it witnessed a flurry of activity, oscillating between highs and lows, mirroring the broader market sentiment. The resilience displayed by NIFTY Spot amidst market turbulence served as a testament to the underlying strength of the market, instilling confidence among investors and stakeholders alike.

Option Chain Dynamics: NIFTY

The option chain dynamics of NIFTY on 14 March 2024 offered a window into the intricacies of derivatives trading. Analysis of open interest for both calls and puts revealed notable changes, shedding light on market sentiment and investor expectations. The top three changes in open interest for calls and puts provided valuable insights into prevailing market sentiment, guiding investors in formulating informed trading strategies.

Option Chain Dynamics: BANKNIFTY

Similarly, the option chain dynamics of BANKNIFTY on 14 March 2024 unraveled a tapestry of market intricacies. Noteworthy changes in open interest for calls and puts offered a glimpse into the sector-specific dynamics influencing banking stocks. By deciphering these changes, investors gained a deeper understanding of market projections and potential avenues for strategic positioning.

Also Read:

- 15 March 2024: Is the Short-lived Relief Rally Over?

- Unveiling the Mystery of Unusual Market Movements

- Mystery Behind 12 March 2024: Who is the Hidden Seller in the Market?

Sectoral Performance

NIFTY NEXT 50:

- Open: The NIFTY NEXT 50 index commenced trading on 14 March 2024 at 56,938.45.

- High: It reached its peak at 58,639.85 during the trading session.

- Low: The index experienced a low of 56,430.85 at a certain point in the day.

- Close: Finally, it closed the trading day at 58,520.20.

- Previous Close: Comparatively, the previous day’s closing value stood at 57,149.55.

- Change: This indicates a notable gain of 2.40% for the NIFTY NEXT 50 index on 14 March 2024.

NIFTY MIDCAP 100:

- Open: On 14 March 2024, the NIFTY MIDCAP 100 index opened trading at 45,658.10.

- High: It reached its highest point during the session at 46,979.75.

- Low: The index experienced a low of 45,293.35 throughout the trading period.

- Close: Ultimately, it concluded trading at 46,901.20.

- Previous Close: The index’s previous day’s closing value was 45,971.40.

- Change: This denotes a noteworthy gain of 2.02% for the NIFTY MIDCAP 100 index on 14 March 2024.

NIFTY AUTO:

- Open: Trading for the NIFTY AUTO index on 14 March 2024 commenced at 20,235.05.

- High: It peaked at 20,569.25 during the day’s trading activities.

- Low: At its lowest point, the index recorded a value of 20,169.85.

- Close: Ultimately, it wrapped up trading at 20,514.25.

- Previous Close: The index’s closing value on the previous day was 20,338.25.

- Change: This signifies a modest gain of 0.87% for the NIFTY AUTO index on 14 March 2024.

NIFTY FMCG:

- Open: Trading began for the NIFTY FMCG index on 14 March 2024 at 53,504.40.

- High: It reached its peak at 54,252.45 during the trading session.

- Low: The index experienced a low of 53,280.20 at a certain point during the day.

- Close: It concluded trading at 54,145.80.

- Previous Close: The index’s closing value on the previous day was 53,664.15.

- Change: This indicates a modest gain of 0.90% for the NIFTY FMCG index on 14 March 2024.

NIFTY IT:

- Open: The NIFTY IT index commenced trading on 14 March 2024 at 36,901.90.

- High: It reached its highest point during the session at 37,723.35.

- Low: At its lowest point, the index recorded a value of 36,607.65.

- Close: Ultimately, it wrapped up trading at 37,679.60.

- Previous Close: The index’s closing value on the previous day was 36,946.45.

- Change: This denotes a notable gain of 1.98% for the NIFTY IT index on 14 March 2024.

NIFTY METAL:

- Open: Trading commenced for the NIFTY METAL index on 14 March 2024 at 7,663.50.

- High: It reached its peak at 7,814.40 during the day’s trading activities.

- Low: The index experienced a low of 7,591.85 during the trading period.

- Close: It concluded trading at 7,799.95.

- Previous Close: The index’s closing value on the previous day was 7,647.40.

- Change: This signifies a notable gain of 1.99% for the NIFTY METAL index on 14 March 2024.

NIFTY PHARMA:

- Open: Trading began for the NIFTY PHARMA index on 14 March 2024 at 18,632.05.

- High: It reached its peak at 18,919.60 during the trading session.

- Low: At its lowest point, the index recorded a value of 18,517.60.

- Close: Ultimately, it wrapped up trading at 18,897.10.

- Previous Close: The index’s closing value on the previous day was 18,635.70.

- Change: This denotes a modest gain of 1.40% for the NIFTY PHARMA index on 14 March 2024.

NIFTY PSU BANK:

- Open: The NIFTY PSU BANK index commenced trading on 14 March 2024 at 6,709.20.

- High: It reached its highest point during the session at 6,847.10.

- Low: The index experienced a low of 6,641.25 at a certain point during the day.

- Close: Ultimately, it wrapped up trading at 6,784.65.

- Previous Close: The index’s closing value on the previous day was 6,737.45.

- Change: This signifies a modest gain of 0.70% for the NIFTY PSU BANK index on 14 March 2024.

NIFTY OIL & GAS:

- Open: Trading began for the NIFTY OIL & GAS index on 14 March 2024 at 11,004.00.

- High: It reached its peak at 11,310.20 during the trading session.

- Low: At its lowest point, the index recorded a value of 10,956.80.

- Close: Ultimately, it wrapped up trading at 11,281.85.

- Previous Close: The index’s closing value on the previous day was 11,025.40.

- Change: This signifies a notable gain of 2.33% for the NIFTY OIL & GAS index on 14 March 2024.

Top Gainers and Losers

The identification of top gainers and losers within Nifty 50 and NiftyBank indices on 14 March 2024 offered invaluable insights into market movers and shakers. Stocks such as ADANIENT, ADANIPORTS, and HINDALCO emerged as top gainers, underscoring the underlying strength of select sectors. Conversely, stocks such as AXISBANK, INDUSINDBK, and BAJFINANCE grappled with losses, reflecting sector-specific challenges and market pressures. This comprehensive analysis empowered investors to make informed decisions, capitalizing on emerging opportunities and mitigating potential risks.

The 14 March 2024 NSE Share Bazaar unfolded with intriguing twists and turns, leaving investors pondering over its underlying dynamics. With meticulous analysis and keen insights into various facets such as index performance, FII/DII activities, and option chain dynamics, a clearer picture emerges, guiding investors through the labyrinth of market fluctuations. As the market oscillates between optimism and skepticism, deciphering the trajectory becomes paramount, delineating between a mere relief rally and a more profound structural shift in market sentiment.

Relief Rally? 14 March 2024 NSE Share Bazaar Analysis & Insights Read More »