Read about the latest developments in the NSE Share Market on 7 March 2024, including Nifty’s new all-time high, BankNifty’s performance, FII/DII data, and sectoral insights. Stay informed about the market trends and option chain analysis.

7 March 2024: NSE Nifty Fifty Sets New All-Time High Amidst Option Expiry

On 7 March 2024, the NSE Nifty Fifty kicked off the trading day with a promising gain of 31 points, opening at 22,505.30, a slight uptick from its previous close of 22,474.05. The index exhibited early strength, soaring to a peak of 22,525.65 at the onset of trading. However, by around 10:45 AM, the Nifty spot experienced a dip, touching a low of 22,430.00, only to rebound and consolidate for the remainder of the day.

Despite the fluctuations, the Nifty managed to clinch a new all-time high, closing at 22,493.55, marking a modest gain of 0.09%. Notably, the day was marked by heightened activity in the options market due to the Nifty Weekly Options Expiry, resulting in some challenges for buyers who found themselves on the losing end.

BankNifty Today: A Slightly Weaker Performance

Simultaneously, Bank Nifty commenced the day on a positive note, witnessing a gain of 70 points, with an opening value of 48,035.80, compared to the previous close of 47,965.40. The banking index reached a peak of 48,071.70 during early trading hours but faced a downturn, hitting a low of 47,747.20 around mid-morning. Following this, Bank Nifty stabilized but closed slightly weaker than its Nifty counterpart, settling at 47,835.80, reflecting a loss of 0.27%.

FII/DII Data: Institutional Buying Dominates

Institutional investors, both Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII), displayed notable activity in the cash segment on 7 March 2024. FIIs made significant purchases amounting to 7,304.11 crores, while DIIs also contributed to buying activity with equity worth 2,601.81 crores. Despite the substantial investments by these institutional players, the market movement didn’t precisely align with the influx of funds, suggesting the possibility of bulk deals that would be reflected on the NSE website. Additionally, FII’s long-to-short ratio in Index futures rose to 0.72, up from 0.66 on the previous day, indicating a bullish sentiment.

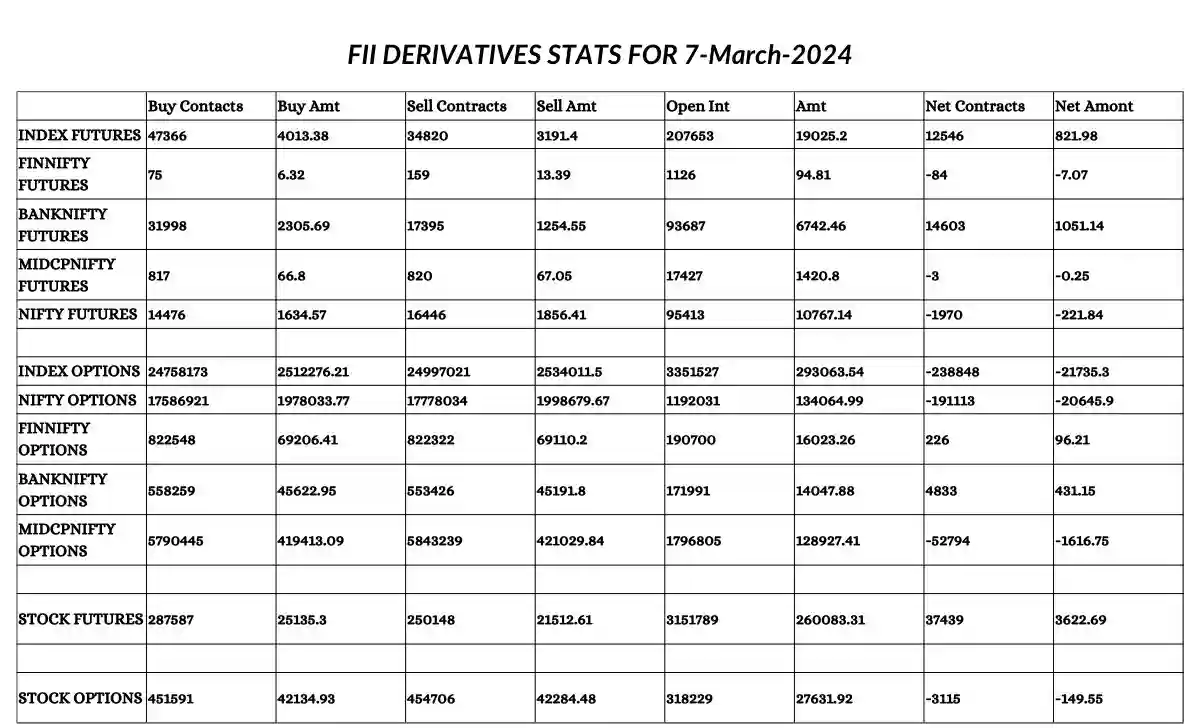

FII Derivative Statistics for 7 March 2024

Feel free to snag the image below, showcasing the FII derivative statistics for 7 March 2024.

Nifty and BankNifty Index Performance Overview

In the Nifty index, top gainers for the day included TATACONSUM, TATASTEEL, and BAJAJ-AUTO, while M&M, BPCL, and RELIANCE were among the top losers. Meanwhile, in the BankNifty index, AUBANK, INDUSINDBK, and SBIN emerged as the top gainers, whereas AXISBANK, IDFCFIRSTB, and FEDERALBNK faced losses.

Also Read:

- 11 March 2024: Nifty 50 and BankNifty Analysis

- On 6 March 2024, NSE Share Bazaar Update

- 5 March 2024 Market Analysis

Sectoral Performance: Nifty Next 50, Nifty Midcap 100, and More

- Nifty Next 50: The Nifty Next 50 index, comprising 50 stocks from diverse sectors, demonstrated a positive trajectory on 7 March 2024. Opening at 59,934.65, the index surged to a high of 60,573.10 before settling at 60,323.90 by the end of the trading day. This remarkable performance translated to a substantial gain of 0.87%, indicating investor confidence in the broader market beyond the top 50 companies represented in the Nifty 50 index. The upward movement in the Nifty Next 50 reflects favorable sentiment towards mid-cap and emerging companies, contributing to the overall bullish sentiment in the market.

- Nifty Midcap 100: Similarly, the Nifty Midcap 100 index, encompassing 100 mid-sized companies, exhibited a positive trend during the trading session on 7 March 2024. Beginning at 48,935.90, the index reached a peak of 49,182.05 before concluding the day at 48,966.15. Although the gain was relatively modest at 0.22%, it underscored the resilience and growth potential of mid-cap companies in the Indian stock market. Investors keen on diversifying their portfolios often look to mid-cap stocks for opportunities beyond large-cap stocks, contributing to the overall stability and vibrancy of the market.

- Nifty Auto: Contrary to the overall positive sentiment, the Nifty Auto index, representing the automotive sector, witnessed a slight decline on 7 March 2024. Opening at 21,141.40, the index experienced fluctuations throughout the day, ultimately closing at 21,126.80. This marginal decrease of -0.26% can be attributed to various factors affecting the automotive industry, including supply chain disruptions, fluctuating demand, and regulatory challenges. Despite the dip, certain automotive companies may have outperformed others, indicating the importance of careful stock selection within the sector.

- Nifty FMCG: In contrast, the Nifty FMCG index, comprising fast-moving consumer goods companies, demonstrated a robust performance on 7 March 2024. Opening at 53,914.00, the index soared to a high of 54,461.05 before settling at 54,406.30 by the end of the trading day. This significant gain of 0.98% underscores the resilience of FMCG companies, which often exhibit stability and consistent demand irrespective of market conditions. Factors such as consumer preferences, brand loyalty, and innovation drive the performance of FMCG stocks, making them a favored choice among investors seeking defensive assets.

- Nifty IT: The Nifty IT index, representing the information technology sector, experienced a positive trajectory on 7 March 2024. Starting at 37,057.95, the index climbed steadily throughout the day, reaching a high of 37,318.95 before settling at 37,099.90. This gain of 0.27% highlights the resilience of the IT sector, which continues to be a key driver of India’s economic growth and global competitiveness. Factors such as digital transformation, remote work trends, and increased IT spending contribute to the optimism surrounding IT stocks, attracting investors seeking exposure to technology-driven companies.

- Nifty Metal: The Nifty Metal index, comprising metal and mining companies, demonstrated a notable uptrend on 7 March 2024. Beginning at 8,290.55, the index surged to a high of 8,436.55 before concluding the day at 8,371.30. This substantial gain of 1.38% reflects renewed investor interest in the metal sector, driven by factors such as infrastructure development, industrial expansion, and global demand for metals. Despite periodic fluctuations, metal stocks continue to be favored by investors seeking exposure to cyclical industries and commodity markets.

- Nifty Pharma: Meanwhile, the Nifty Pharma index, representing pharmaceutical companies, maintained a steady course on 7 March 2024. Opening at 19,158.15, the index reached a high of 19,277.70 before settling at 19,194.10 by the end of the trading day. This marginal gain of 0.28% underscores the defensive nature of the pharmaceutical sector, which tends to exhibit resilience during periods of market volatility. Factors such as healthcare innovation, regulatory approvals, and global demand for medicines contribute to the long-term growth prospects of pharma stocks, attracting investors seeking stability and growth potential.

- Nifty PSU Bank: Lastly, the Nifty PSU Bank index, comprising public sector banks, witnessed a moderate uptick on 7 March 2024. Beginning at 7,349.70, the index reached a high of 7,409.00 before settling at 7,341.25. This gain of 0.22% reflects the mixed performance of PSU banks, which continue to grapple with challenges such as asset quality concerns, regulatory pressures, and market competition. While certain PSU banks may have shown resilience and growth potential, the sector as a whole remains subject to various macroeconomic factors and policy developments, influencing investor sentiment and market dynamics.

Option Chain Analysis: NIFTY and BANKNIFTY

The option chain data for Nifty revealed notable changes in Open Interest for both calls and puts. In the calls category, significant changes were observed in 22500CE, 22600CE, and 22300CE, while in the puts category, 22600PE, 22400PE, and 22500PE showed substantial shifts.

For BankNifty, the option chain data indicated considerable changes in Open Interest Calls for 47800CE, 47900CE, and 48000CE, whereas in the Puts category, 48000PE, 47900PE, and 47800PE saw notable alterations.

In conclusion, despite the challenges posed by the options expiry, the NSE market witnessed a day of mixed performances across various indices, fueled by active institutional participation and sector-specific movements. Investors remain vigilant amidst the evolving market dynamics, keeping a close watch on forthcoming developments and opportunities.