NSE Share Bazaar Analysis on 28 February 2024: Navigating the Volatility

Explore the dynamic shifts in the NSE Share Bazaar on 28 February 2024, including Nifty and Bank Nifty performance, institutional activity, sectoral analysis, and option chain insights. Gain valuable insights for informed decision-making amidst market volatility.

28 February 2024: NSE Share Bazaar Overview

On 28 February 2024, the NSE Share Bazaar commenced on a positive note, gaining 16 points from the previous close to open at 22,214.10. The market sentiment was initially optimistic as the Nifty Fifty soared to a high of 22,229.15 during the opening trade. However, the bullish momentum subsided later in the day, leading to a downward spiral. Around 10:40 AM, the market witnessed sudden selling pressure, causing the Nifty to plummet to a low of 21,915.85. Despite attempts at recovery post-1 PM, the bearish trend persisted, ultimately resulting in the Nifty closing at 21,951.15, marking a loss of 1.11%. Notably, it’s crucial to observe that tomorrow signals the monthly expiry of derivative contracts, which could significantly impact market dynamics.

NiftyBank Performance on 28 February 2024

Simultaneously, on the same day, Bank Nifty opened with a gain of 52 points at 46,640.90 compared to the previous day’s close. The initial optimism saw the NiftyBank reaching a high of 46,754.55 by 10:25 AM. However, similar to the Nifty, the banking index succumbed to selling pressure, witnessing a dip to 45,852.55. Despite sporadic attempts at recovery, bears dominated the scene, leading to a closing figure of 45,963.15, marking a loss of 1.34%, surpassing the downturn experienced by Nifty50.

Institutional Cash Activity: FII vs. DII

The institutional activity on 28 February 2024 saw Foreign Institutional Investors (FII) offloading stocks worth 1,879.23 crores in the cash segment. Conversely, Domestic Institutional Investors (DII) displayed a contrasting trend by purchasing equities valued at 1,827.45 crores in the cash segment. Despite this equilibrium in buying and selling from institutional players, the NSE Share Bazaar observed a decline exceeding 1 percent. Furthermore, the long-to-short ratio in FII’s Index futures fell from 0.84 to 0.83, highlighting a shift in market sentiment.

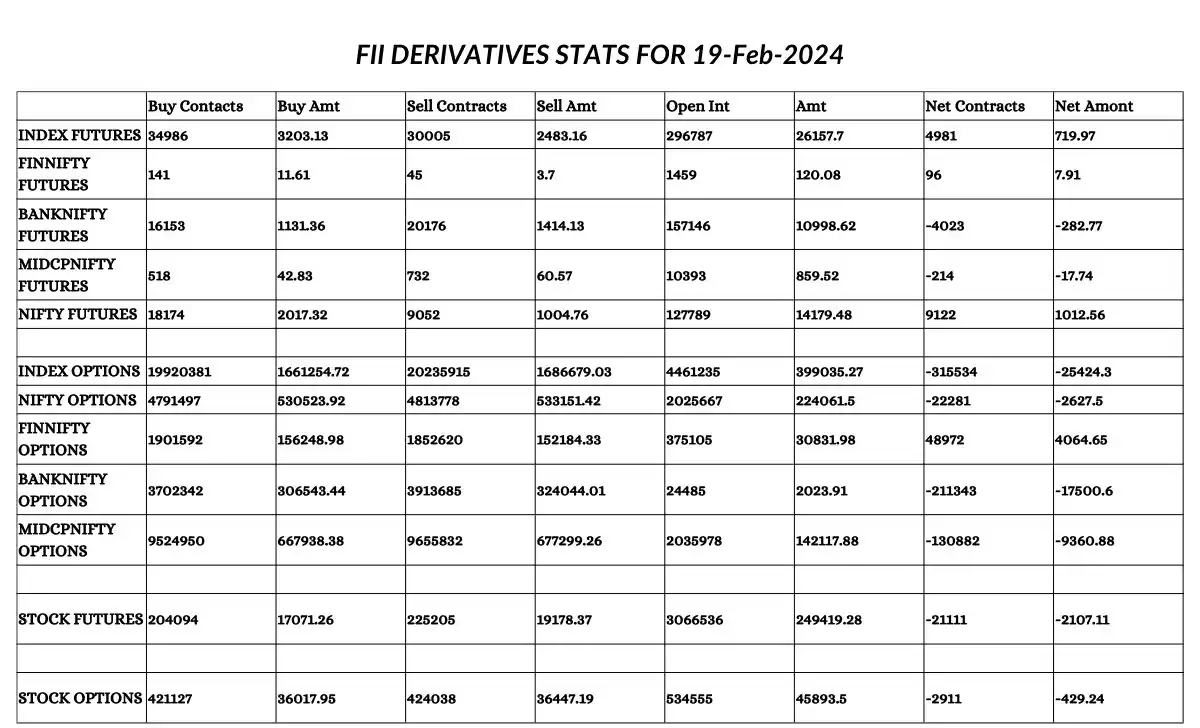

FII Derivative Statistics for 28 February 2024

You can download the image below containing the FII derivative statistics for 28 February 2024

Nifty and Bank Nifty Performance Metrics

Nifty, the benchmark index, experienced a tumultuous trading session on 28 February 2024. The index opened at 22,214.10 and peaked at 22,229.15 but succumbed to selling pressure, closing at 21,951.15, indicating a decline of 1.11% from the previous close. Conversely, Bank Nifty opened at 46,640.90, reaching a high of 46,754.55 before settling at 45,963.15, marking a loss of 1.34% compared to the previous day’s close.

Top Gainers and Losers

In the Nifty Index Movers, notable gainers included HINDUNILVR, BHARTIARTL, and INFY, while POWERGRID, BAJAJ-AUTO, and APOLLOHOSP emerged as the top losers. In the Bank Nifty Index, all stocks concluded in red, with AUBANK, IDFCFIRSTB, and BANKBARODA recording significant losses.

Also Read:

- 29 February 2024: Nifty Fifty Today and FII/DII Data

- 27 February 2024: NSE Share Market Surges

- 26 February 2024: NSE Nifty Fifty’s Performance Unveiled

Sectoral Performance

The Sectoral Indices encompass various sectors, each contributing uniquely to the overall market performance. On 28 February 2024, the sectoral performance within the Nifty Index depicted a mixed picture, reflecting the diverse trends and sentiments prevailing in different segments of the economy.

- Nifty Next 50: This index represents the performance of the next set of 50 stocks listed on the NSE in terms of market capitalization. Despite opening at 59,296.00, it experienced a decline throughout the trading session, closing at 58,387.30, marking a loss of 1.29% from the previous day’s close. This suggests a general downturn among mid-cap stocks.

- Nifty Midcap 50: Reflecting the performance of mid-sized companies, the Nifty Midcap 50 opened at 13,956.85 and closed at 13,618.25, indicating a decline of 2.25%. This segment witnessed considerable volatility, possibly influenced by market-wide factors impacting mid-cap stocks.

- Nifty Auto: The Nifty Auto index, comprising automobile companies, opened at 20,808.40 and closed at 20,372.35, marking a decline of 2.00%. Factors such as changes in consumer sentiment, regulatory developments, and input costs may have influenced the performance of this sector.

- Nifty FMCG: FMCG (Fast-Moving Consumer Goods) companies constitute the Nifty FMCG index. Despite opening at 54,406.30, the sector witnessed a decline, closing at 53,824.90, down by 0.89%. Consumer spending patterns, input costs, and competitive dynamics could have impacted the performance of FMCG stocks.

- Nifty IT: The IT sector, represented by the Nifty IT index, opened at 37,926.65 and closed at 37,741.75, marking a marginal decline of 0.34%. Factors such as global economic conditions, currency fluctuations, and demand for IT services may have influenced the performance of IT stocks.

- Nifty Metal: The Nifty Metal index, comprising metal and mining companies, opened at 8,030.90 and closed at 7,850.35, indicating a decline of 1.88%. This sector is often sensitive to factors such as commodity prices, global demand, and trade policies.

- Nifty Pharma: Pharma companies form the Nifty Pharma index. Opening at 19,094.40 and closing at 18,942.55, the sector experienced a decline of 0.64%. Regulatory developments, R&D pipeline, and global health trends are crucial factors influencing pharma stock performance.

- Nifty PSU Bank: PSU (Public Sector Undertaking) banks constitute the Nifty PSU Bank index. This segment opened at 7,002.40 and closed at 6,840.60, marking a decline of 2.30%. Factors such as asset quality, regulatory compliance, and government policies impact the performance of PSU banks.

- Nifty Oil & Gas: The Nifty Oil & Gas index represents companies in the oil and gas sector. Opening at 11,684.50 and closing at 11,441.60, the sector saw a decline of 2.08%. Factors such as oil prices, global demand-supply dynamics, and regulatory changes influence the performance of oil and gas stocks.

Overall, the sectoral performance within the Nifty Index on 28 February 2024 reflected a broad-based decline, influenced by a combination of macroeconomic factors, sector-specific developments, and market sentiment. Investors closely monitored these sectors for insights into prevailing market trends and potential investment opportunities.

Option Chain Analysis

The option chain data for NIFTY and BANKNIFTY, with a 29 February 2024 expiry, revealed significant changes in open interest for both calls and puts. Notably, for NIFTY, 22000CE and 22100CE witnessed notable increases in open interest calls, while 22000PE and 22100PE experienced declines in open interest puts. Similarly, in BANKNIFTY, 46000CE and 45900CE saw notable increases in open interest calls, whereas 46000PE and 46500PE observed declines in open interest puts.

In conclusion, the trading session on 28 February 2024 depicted a volatile market scenario influenced by various factors, including institutional activity, sectoral performance, and derivative contracts’ expiry. As investors gear up for the upcoming trading day on 29 February 2024, cautious optimism prevails amidst the prevailing market uncertainty.

NSE Share Bazaar Analysis on 28 February 2024: Navigating the Volatility Read More »