On 19 February 2024, the Nifty Fifty index commenced trading on a positive note, opening higher at 22,103.45 compared to the previous day‘s close of 22,040.70. Despite an initial dip to a low of 22,021.05, the Nifty 50 swiftly rebounded and reached a high of 22,186.65. Notably, the day witnessed lower volatility compared to the preceding sessions. Eventually, Nifty closed at 22,122.25, marking a gain of 0.37%. The day’s performance showcased a steady trajectory for Nifty, reflecting a resilient market sentiment.

Today’s NSE Share Bazaar

Nifty Bank Today

Simultaneously, Bank Nifty today exhibited positive momentum, starting its journey with a gain of 170 points at 46,554.90 from the previous close of 46,384.85. The index registered a low of 46,317.70 in early trade but recovered swiftly, reaching a high of 46,717.40 during the day. However, Bank Nifty closed slightly below its peak at 46,535.50, recording a gain of 0.32%. While Bank Nifty today showcased upward movement, its gains were relatively lower compared to Nifty, indicating nuanced dynamics within the banking sector.

FII DII Cash Data Analysis for 19 February 2024

Analyzing FII/FPI and DII trading activity on 19 February 2024 reveals notable trends. While DIIs exhibited a buying spree with equity purchases worth 452.70 crores, FIIs engaged in selling, with net sales amounting to 754.59 crores in the cash segment. This contrast in institutional behavior reflects divergent market perspectives. Notably, the long-to-short ratio in FII index futures increased steadily, reaching 0.65, underscoring FIIs’ cautious stance amidst market fluctuations.

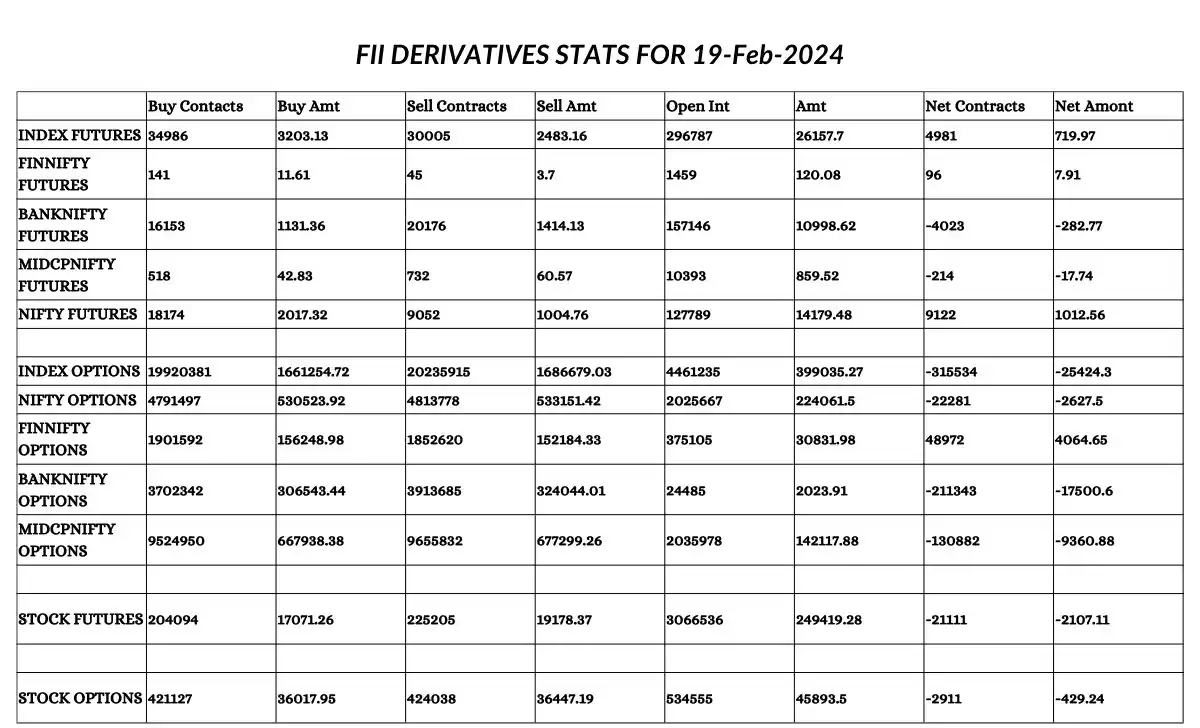

FII Derivative Statistics for 19 February 2024

You can download the image provided below, which contains the FII derivative statistics for 19 February 2024.

Nifty Index Insights

Examining the NSE Nifty’s performance on 19 February 2024, the index demonstrated resilience amidst market volatility. Opening at 22,103.45, Nifty witnessed intraday fluctuations, with a high of 22,186.65 and a low of 22,021.05. However, it managed to sustain upward momentum, eventually closing at 22,122.25, marking a gain of 0.37%. Noteworthy gainers in the Nifty index included GRASIM, BAJAJFINSV, and BAJAJ-AUTO, while COALINDIA, LT, and SBILIFE emerged as top losers.

Also Read:

BankNifty Performance Overview

BankNifty, reflecting the banking sector’s performance, displayed a similar trend to Nifty on 19 February 2024. Opening at 46,554.90, the index experienced fluctuations throughout the day, with a high of 46,717.40 and a low of 46,317.70. Despite facing early challenges, BankNifty closed positively at 46,535.50, registering a gain of 0.32%. Notable gainers in the BankNifty index included AUBANK, ICICIBANK, and BANDHANBNK, while BANKBARODA, PNB, and FEDERALBNK emerged as top losers.

Sectoral Indices Performance Analysis

In addition to the broader indices like Nifty and BankNifty, sectoral indices offer valuable insights into the performance of specific segments within the market. Let’s delve into the performance of key sectoral indices on 19 February 2024:

- NIFTY NEXT 50: The NIFTY NEXT 50 index tracks the performance of the next 50 companies after the Nifty 50 on the NSE. On 19 February 2024, it opened at 58,838.30 and reached a high of 58,897.75. Despite fluctuations, it closed at 58,650.30, reflecting a modest gain of 0.11%. This index’s performance provides insights into the broader market beyond the top 50 companies, offering a glimpse into mid-cap companies’ performance.

- NIFTY MIDCAP 50: The NIFTY MIDCAP 50 index represents the performance of the top 50 mid-cap companies on the NSE. Opening at 14,092.45, it experienced slight fluctuations throughout the day, with a high of 14,092.50 and a low of 14,009.95. Eventually, it closed at 14,022.25, indicating a marginal decline of 0.09%. The performance of this index sheds light on the growth potential and risk appetite associated with mid-cap stocks.

- NIFTY AUTO: The NIFTY AUTO index comprises companies in the automobile sector. Opening on 19 February 2024 at 20,514.20, it saw a high of 20,548.80 and a low of 20,380.90. It closed at 20,481.60, marking a gain of 0.28% from the previous close. This index’s performance is influenced by factors such as consumer sentiment, demand for vehicles, and regulatory changes impacting the automotive industry.

- NIFTY FMCG: The NIFTY FMCG index represents the fast-moving consumer goods sector. Opening at 53,645.55, it reached a high of 54,121.60 and a low of 53,576.00. It closed at 53,943.30, reflecting a notable gain of 0.79% from the previous close. This index’s performance is indicative of consumer spending patterns, brand strength, and market penetration of FMCG companies.

- NIFTY IT: The NIFTY IT index tracks the performance of IT companies listed on the NSE. Opening on 19 February 2024 at 38,526.95, it reached a high of 38,559.85 and a low of 38,042.65. It closed at 38,363.15, indicating a slight decrease of 0.30% from the previous close. This index’s performance is influenced by global technological trends, currency fluctuations, and demand for IT services.

- NIFTY METAL: The NIFTY METAL index comprises companies in the metal sector. Opening at 8,018.35, it reached a high of 8,035.50 and a low of 7,965.00. It closed at 7,981.25, marking a marginal gain of 0.06% from the previous close. This index’s performance is closely linked to factors such as commodity prices, global demand, and government policies affecting the metal industry.

- NIFTY PHARMA: The NIFTY PHARMA index represents pharmaceutical companies listed on the NSE. Opening at 18,938.70, it reached a high of 19,079.30 and a low of 18,897.20. It closed at 19,037.70, reflecting a gain of 0.88% from the previous close. Factors such as regulatory approvals, research and development pipelines, and global healthcare trends influence this index’s performance.

- NIFTY PSU BANK: The NIFTY PSU BANK index tracks the performance of public sector banks in India. Opening at 7,165.35, it reached a high of 7,185.15 and a low of 7,090.35. It closed at 7,101.40, marking a decrease of 0.47% from the previous close. This index’s performance is closely tied to factors such as government policies, economic conditions, and asset quality of public sector banks.

- NIFTY OIL & GAS: The NIFTY OIL & GAS index represents companies in the oil and gas sector. Opening at 11,893.60, it reached a high of 11,995.65 and a low of 11,849.25. It closed at 11,919.70, reflecting a gain of 0.55% from the previous close. This index’s performance is influenced by factors such as crude oil prices, global demand-supply dynamics, and regulatory changes affecting the energy sector.

Option Chain Data Analysis for 19 February 2024

Delving into option chain data for Nifty and BankNifty reveals significant insights into market sentiment and expectations. In the Nifty option chain for the 22 February 2024 expiry, notable changes in open interest (OI) were observed, particularly in the 22200CE and 22100PE strikes. Conversely, for BankNifty’s option chain with a 21 February 2024 expiry, substantial changes were recorded in the 46500PE and 46400PE strikes. These changes highlight evolving market dynamics and investor strategies ahead of the respective expiry dates.

Conclusion

The trading session on 19 February 2024 portrayed a mix of optimism and caution in the Indian stock market. While Nifty and BankNifty showcased positive gains, institutional trading patterns underscored nuanced market sentiments. Option chain data provided further insights into market expectations and investor strategies. As investors navigate through dynamic market conditions, staying informed about key indices and institutional activities remains paramount for making informed investment decisions.