2 February 2024: NSE Share Bazaar and FII DII Data Analysis

Explore market trends on 2 February 2024 with comprehensive FII/FPI derivative data. Gain insights into NSE’s dynamic performance in this informative analysis.

On 2 February 2024, the NSE Share Bazaar showcased significant volatility following the Budget day. The Nifty index opened with a gap up at 21,812.75, surpassing the previous close of 21,697.45. In the first half of trading until noon, the Nifty reached a new life high of 22,126.80. However, a shift in market sentiment led to selling pressure in private banks, resulting in a low of 21,812.75 within the next hour and a half. The Nifty eventually closed at 21,853.80, securing a gain of 0.72%. Notably, more than half of its initial gains were lost in the later part of the trading session, primarily attributed to weakness in the banking sector.

The NIFTY Bank also witnessed a positive opening at 46,568.20 compared to the previous day’s close of 46,188.65. It reached a high of 46,892.35 at noon but experienced sudden selling pressure, leading to a low of 45,901.25. The BankNifty closed near the day’s low at 45,970.95, marking a decrease of 0.47%. A stark contrast was observed between Nifty, which ended the day up 0.72%, and BankNifty, which closed down 0.47%. The BankNifty saw a significant dip of nearly 1000 points from its intraday highs.

Also Read:

- NSE Share Bazaar Update – 1 February 2024

- 5 February 2024 Volatile Day on NSE Share Bazaar

- Bulls Charge Ahead on 31 January 2024 with Robust FII DII Data

Market Indices Overview: On 2 February 2024

NIFTY:

- Open: 21,812.75

- High: 22,126.80

- Low: 21,805.55

- Close: 21,853.80

- Previous Close: 21,697.45

- Change: 0.72%

Top gainers in NIFTY:

- BPCL

- POWERGRID

- ONGC

Top losers in NIFTY:

- EICHER MOTORS

- AXIS BANK

- HDFC LIFE

BANKNIFTY:

- Open: 46,568.20

- High: 46,892.35

- Low: 45,901.25

- Close: 45,970.95

- Previous Close: 46,188.65

- Change: -0.47%

Top gainers in BANKNIFTY:

- PNB

- BANDHAN BANK

- KOTAK BANK

Top losers in BANKNIFTY:

- AXIS BANK

- HDFC BANK

- AU BANK

Other Market Indices:

- NIFTY NEXT 50: +0.78%

- NIFTY AUTO: +0.27%

- NIFTY MIDCAP 50: +0.95%

- NIFTY FMCG: -0.18%

- NIFTY IT: +2.16%

- NIFTY METAL: +2.37%

- NIFTY PHARMA: -0.74%

- NIFTY PSU BANK: +2.22%

FII and DII Activity:

On 2 February 2024, FII/FPIs and DIIs exhibited active trading in the capital market segment. FII bought equities worth ₹70.69 crores, while DIIs bought equities valued at ₹2,463.16 crores. This trading activity reflected the dynamic nature of the market on that particular day.

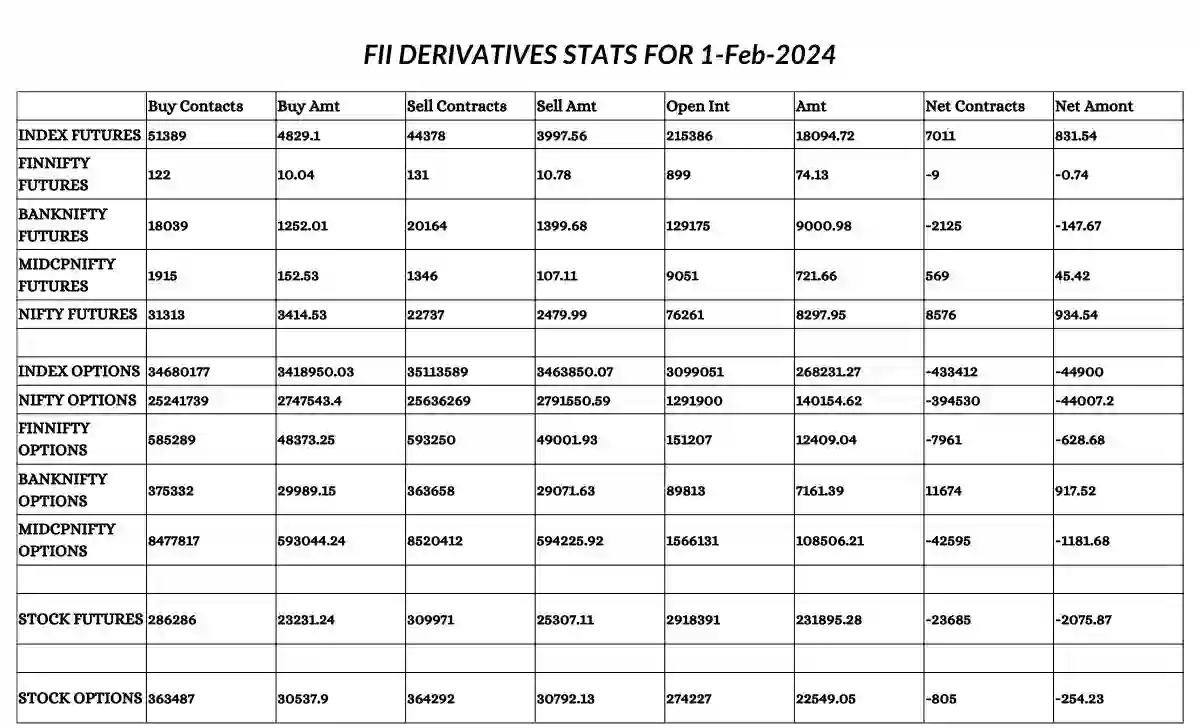

FII Derivative Statistics for 2 February 2024:

You can download the image below for the FII derivative stats for 2 February 2024 for your reference:

Option Chain Data:

For NIFTY (8 Feb 2024 Expiry):

- Top three changes in Open Interest Calls:

- 21700CE: -35,466

- 21800CE: -31,950

- 21900CE: 8,560

- Top three changes in Open Interest Puts:

- 22000PE: 29,008

- 21900PE: 40,293

- 21800PE: 28,007

For BANKNIFTY (7 Feb 2024 Expiry):

- Top three changes in Open Interest Calls:

- 46000CE: -36,693

- 45500CE: -7,559

- 45900CE: 6,523

- Top three changes in Open Interest Puts:

- 46500PE: 24,287

- 46100PE: -10,186

- 46000PE: -42,142

conclusion:

In conclusion, the trading day of 2 February 2024 witnessed notable market movements, especially in the banking sector. The Nifty’s resilience amid the volatility and the contrasting performance of the BankNifty highlight the diverse dynamics at play in the NSE Share Bazaar on that particular day. Investors closely monitored FII/FPI and DII activities, recognizing the impact of these institutional players on market trends. The option chain data further provides insights into the expectations and strategies of market participants in the upcoming sessions.

2 February 2024: NSE Share Bazaar and FII DII Data Analysis Read More »